Mark Florman defines ERR; Awards deadline Friday

With shareholders most concerned with IRRs, the wider public has long been talking about the industry’s wider impact on society. Specialist industry adviser Mark Florman talks with Kimberly Romaine about measuring positive externalities

That private equity impacts more than just its shareholders has never been more evident. EVCA's appointment last week of its first LP chairman was testament to the industry's need to engage with a wider stakeholder base.

While the industry is long on performance metrics, it is woefully short on measuring its wider contribution to society, according to Mark Florman, formerly BVCA chairman and now a special adviser to the industry.

"This industry is particularly good at generating [positive externalities] but particularly poor at mentioning it," he says. "Many assume the external impact [of private equity] is neutral, or even negative if we have to cut jobs. In emerging markets, the presumption is that private equity and venture capital will only ever make a positive contribution. A metric to show the contribution to job creation, tax generation, to the environment, to land use, to IP, product development, local supply chains, manufacturing skills... that is your external rate of return (ERR). It can be negative, but I'm pretty certain that it's usually positive."

Florman talks with unquote" about measuring PE's positive externalities

The unquote" Awards celebrate innovation and excellence in the British private equity industry. Entrants are encouraged to shout about their positive ERRs – particularly in the GP categories, where detailing exits. Last year, every exit on our competitive Shortlist had generated jobs for the businesses they backed – an achievement the judges were incredibly proud of.

Entries for this year's Awards are due this Friday by 4pm. Details, including entry forms, can be found on the awards site. Be sure to read our tips for entering.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

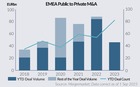

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater