Analysis / Venture

Women in PE: Earth Capital's Bezuidenhoudt and Hockley on 2024 fund launch progress and co-investment pipeline

UK-based impact investorтs female leaders discuss deployment plans and the advantages of its syndicate co-investment strategy

VC Profile: NetScientific's EMV gears up for debut fund targeting early-stage deep-tech startups

UK-based investment platform will step up investments in existing portfolio, while securing commitments for its thematic fund by year-end

European VCs need to match actions to words by increasing funding to female-led companies

Women-led startups usually receive less than 2% of VC capital, but more diverse, defensible female-founded businesses emerging

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

VC Profile: HTGF optimistic on seed stage opportunities as exit environment toughens

German seed investor secured almost EUR 500m for its fourth and biggest fund to date at a time when VC funding is slowing down

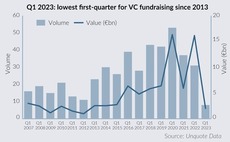

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II

VC Profile: Target Global assesses B2B opportunities in final stretch of current fund deployment

Nearing full deployment for its second growth fund, pan-European VC firm outlines plans to back defensive B2B models and institutionalise its co-investment strategy and LP base

Series A rounds likely bright spots in VC investing in Q1 2023 – KPMG

Energy security, ESG deals to continue apace, with consumer-focused businesses seeing most strain

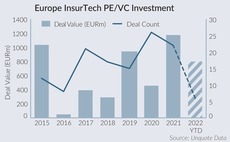

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

GP Profile: Nordic Alpha Partners on hard-tech, hypergrowth mode

Co-founder Laurits Bach SУИrensen tells Unquote about the Danish growth investorтs value creation model and plans for future investments

HealthCap looks to future growth after new appointments

Venture capital firm HealthCap is looking ahead to a busy healthcare and life sciences market

GP Profile: HPE Growth sets the stage for next fundraise

Manfred Krikke and Tim van Delden on the firm's growth plans, fundraising intentions, and the importance of European digital technology

Podcast: In conversation with… Kerry Baldwin, IQ Capital & BVCA

New BVCA chair discusses her priorities for the year ahead, the buoyant environment for venture, how to improve PE's public image, and more

VC fundraising enjoys strong 2020 vintage, sunny prospects

With record amounts of capital raised for the strategy, venture capital fundraising does not appear to have been slowed by the pandemic

Pandemic success boosts appeal of "misunderstood" gaming sector

PE and VC interest for the sector has picked up in the past few years after a lull, and the pandemic could turn some of these bets into winners

Video: "A day in the life" of Beringea CIO Karen McCormick

McCormick shares her experience of a typical day working from home, and her outlook for venture and growth capital trends in 2021

Evolving VC landscape helps fuel venture secondaries

Backing a portfolio of companies after various funding rounds gives comfort to some investors, with valuations seen as more concrete

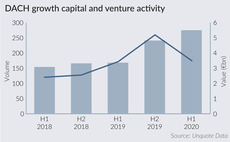

DACH venture and growth deals peak in crisis

Following a strong year in volume terms, market participants remain optimistic about the resilience of the venture ecosystem

Southern Europe's VC industry grows amid pandemic

VC ecosystem has not been immune to Covid-19, but has been able to react more promptly than traditional segments of the PE market

EQT Growth's bet on maturing European startups

New growth investor plans to announce at least one deal by the end of the year, says partner Carolina Brochado

Video: Frog Capital's Mike Reid on growth equity's chance to shine

Reid recaps a busy year for Frog and shares his experience of dealing with the Covid-19 crisis

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Venture, tech keep UK market afloat in H1

Buyout and exit volume dropped dramatically in the first half of 2020, while GPs are doubling down on technology-driven strategies