AP6 invests in EQT’s Bureau van Dijk

Swedish pension fund Sjätte AP-fonden (AP6) has taken a 3% stake in EQT-owned business information company Bureau van Dijk (BvD) through a direct co-investment.

The investment was made when the deal was closed at the end of 2014, as EQT syndicated out part of its equity investment to LPs.

AP6 is an LP in the €4.75bn EQT VI fund, which acquired BvD in a July 2014 deal reported to be worth in excess of €1bn.

EQT offered direct investment opportunities in BvD to LPs in its EQT VI fund to bring down the size of the GP's own equity stake to a level more in line with the fund's target investment size, AP6 investment director Fabian Dahl told unquote".

The Swedish pension fund has a track record of direct investments and co-investments, allocating 41% of its SEK 22.1bn in capital to direct investments and 27% to fund investments.

Investment director Vidar Andersch said AP6 both co-invests in opportunities offered by GPs, as well as originates its own direct investments. The investment manager added that AP6's equity tickets range from €10-100m per investment.

AP6 has previously participated in deals such as Nordic Capital's secondary buyout of Lindorff from Altor, and HgCapital's investment in Visma.

Previous funding

The investment by AP6 follows that of EQT. The latter is BvD's fourth private equity owner, having bought the company from Charterhouse, which itself had acquired it from BC Partners for €960m in July 2011.

BC's original purchase of BvD was a secondary buyout from Candover in 2007, which represented a 2.3x return on Candover's initial investment. The deal value was thought to stand at around €300m.

Company

Amsterdam-based BvD was founded in 1991 and has 650 employees operating in 33 offices across Europe, the Americas and Asia-Pacific.

The publisher provides information about private companies and corporate structures, primarily to business clients.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

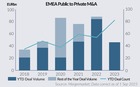

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater