Sponsor Capital closes fourth fund on €200m hard-cap

Finnish GP Sponsor Capital has held a first and final close for its fourth fund, Sponsor Fund IV, on its €200m hard-cap.

Based in Helsinki, Fund IV was announced in the spring of 2014 with a €175m target – the same size as Sponsor's previous fund – and had hit its hard-cap by the summer.

Managing partner Kaj Hägglund told unquote" the fund was more or less ready in June, but because this was the first fund to be raised in Finland following the implementation of the AIFMD, the Finnish regulators took more time completing the necessary paperwork. Hägglund noted that fundraising had otherwise been very straightforward.

Carry, hurdle and management fees are the same as the GP has had on all its previous funds, and in line with industry standard. Likewise, the new vehicle's lifespan follows the traditional 10-year model with two one-year extensions.

Alongside the close, Sponsor has added three new partners to its team.

Investors

Sponsor Fund IV will have the same investor base as the Finnish manager's previous funds, with the addition of one new investor.

According to unquote" data, LPs in Sponsor's previous funds included government-backed Finnish Industry Investment, Finvest (now eQ), Ilmarinen Mutual Pension Insurance Company, Nordea, publicly listed Finnish investment company Norvestia, and Varma Mutual Pension Insurance Company.

Minimum subscriptions to the fund were €10m, while the GP committed 2.5% of the capital with €5m. There were no cornerstone investors.

Investments

The new fund will follow the same strategy as Sponsor's previous funds. The GP will take majority stakes in mid-sized Finnish companies with net sales typically ranging between €15-150m.

The close was a dry close with no investments made yet, as the firm's previous fund is still active. The investment period is expected to begin in January 2015.

Founded in 1997, the Helsinki-based GP specialises in management buyouts, growth capital and co-investments, committing between €5-30m on average, holding investments for 3-5 years.

Sponsor's last fund, Sponsor Capital III, was announced in April 2007 and raised €175m, exceeding its €120-140m target and €150m hard-cap. All commitments to the 10-year fund were made by investors from the GP's previous fund. The minimum subscription was €10m.

According to unquote" data, Sponsor has previously invested most heavily in industrial businesses, with investments in the industry through all its earlier funds totalling more than €400m.

Since its foundation, the GP has invested in more than 20 Finnish companies, including Lujapalvelut and Espotel.

People

Kaj Hägglund is managing partner of Sponsor. Jussi Seppälä and Thomas Sandvall are newly hired partners, alongside Matti Virolainen who was promoted from within the firm.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

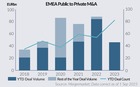

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater